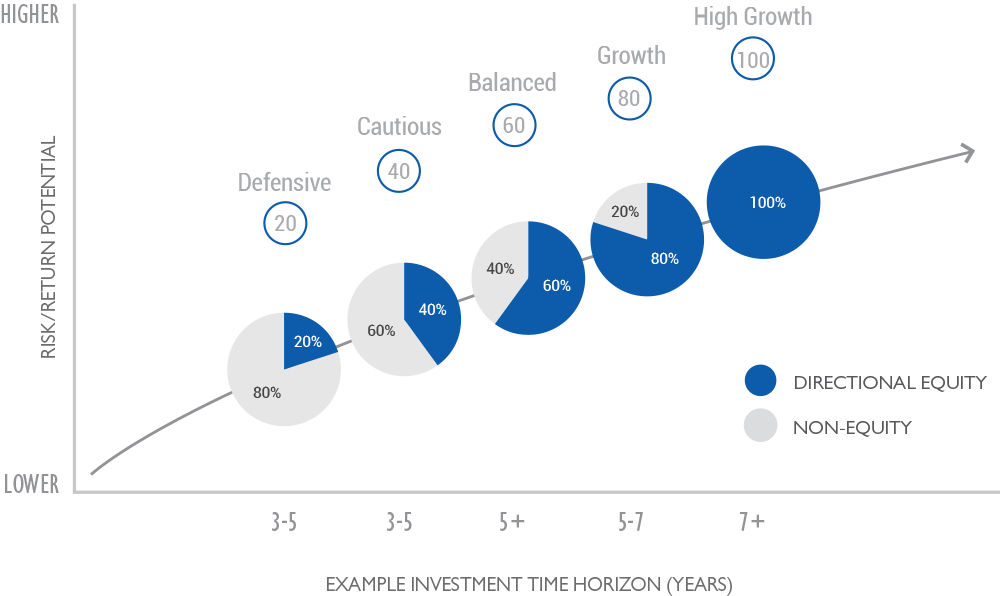

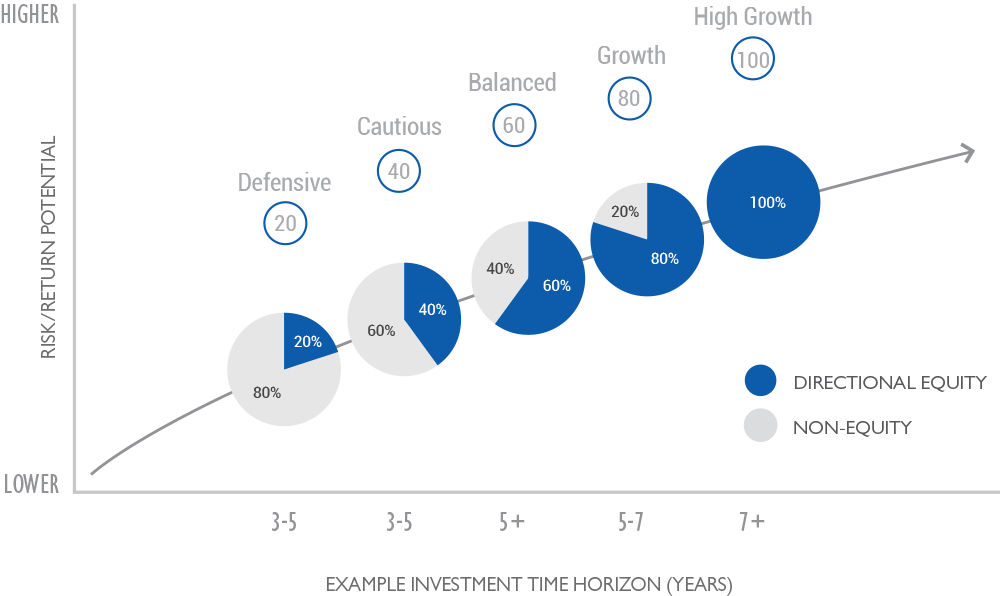

Our Active range offers five risk-graded portfolios designed for different client profiles. Each portfolio’s name includes a number showing its typical equity exposure, giving clients a clear, transparent way to set expectations and compare our models with peers.

Defensive 20

Defensive 20

A portfolio that seeks to generate modest returns, higher than cash in the bank, over the short to medium term.

Cautious 40

Cautious 40

Designed for conservative investors. Blends a modest equity allocation with a core of defensive assets to reduce volatility and target long-term inflation-beating returns.

Balanced 60

Balanced 60

A well-diversified mix of equities and bonds for investors seeking a balance of risk and reward over the medium to long term. Ideal for clients with a 5+ year horizon.

Growth 80

Growth 80

For investors comfortable with risk and focused on long-term capital growth. Primarily equity-based, with some exposure to lower-risk assets for balance.

High Growth 100

High Growth 100

Aiming for strong capital appreciation through a high-conviction equity strategy. Suitable for those with a long investment horizon and high tolerance for volatility.

The diagram is for illustrative purposes only. The value of investments, and the income from it, may go down as well as up and may fall below the amount initially invested. Weightings may deviate from these levels at the Investment Team's discretion whilst staying within specific guidelines, so the above asset allocation is intended as a guide only.