TAM TALKS – WEEKLY MARKET UPDATES

Rate Cuts, Sector Swings, and Europe’s Next Moves

The U.S. Federal Reserve cut interest rates by 25 basis points this week — its first rate cut since December.

Market Crosscurrents: Inflation Peaks, Gold Surges, and Fed Cut Odds Rise

Inflation shows signs of peaking, fueling a surge in gold as investors seek safe havens. At the same time, rising expectations of a Fed rate cut add momentum to shifting market dynamics.

Markets Find Relief as Fed Shifts Tone

Political instability, trade tensions, and lower bond yields create a complex environment for investors, acting as both a headwind and a potential support for markets.

Solid business activity, however, helps stabilize European markets by providing a co...

Markets Walk the Tightrope

Global financial markets navigate a precarious balance between growth and risk, with factors like inflation and geopolitical tensions creating an unstable tightrope.

Investors and institutions must carefully move forward, as any misstep could lead to s...

Tariffs, Rate Cuts, and Resilient Earnings Shape the Week

European corporate earnings show resilience, led by finance and healthcare sectors, despite pressures from tariffs and a strong euro. The BoE's surprise rate cut and easing geopolitical tensions offer some market relief, yet trade-related uncertainty persists due...

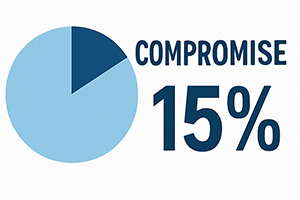

The 15% Compromise

Markets welcomed a partial EU–US trade deal, avoiding a full-blown trade war, though a 15% tariff on key EU exports remains. AI optimism and strong US tech earnings—especially from the "Magnificent Seven"—continue to drive market performan...

Strong Earnings Calm Inflation Fears

Positive corporate profit reports are easing concerns about rising inflation, suggesting companies can manage higher costs.

This has shifted investor focus to the fundamental strength of businesses, boosting market confidence.

The Boy Who Cried Tariff

Last week showed how markets grow numb to constant threats—what once sparked panic now gets little reaction.

The media even dubbed this desensitisation the "TACO Trade"—Trump Always Chickens Out.

Tariffs, Debt, and No Fear

The trade outlook remains murky as the US tariff pause expires on 9 July.

The US is back in hardball mode, but markets seem numb to Trump’s threats and reversals as stocks keep pushing to record highs.

Dodging Bullets, For Now

This was a week when everything could’ve gone wrong—but didn’t. Quite the opposite.

Israel and Iran agreed to a ceasefire (for now), oil prices fell—easing inflation concerns—and US economic data continues to soften just e...

TAM Talks - Weekly Update - 24th June 2025

Markets were jolted early Monday after U.S. strikes on Iranian nuclear targets sparked fears of supply disruption.

Cooling Prices, Hot Politics

Markets entered the week hoping for calm and got just enough of it—until oil surged late Friday on renewed Middle East tensions.

Markets Climb as Musk and Trump Go Full Springer

The largest tax cut in American history—delivered a major plot twist, reigniting concerns over deficits and a ballooning national debt. It also triggered a public fallout between Trump and Elon Musk, playing out in true Jerry Spring...

Risk-On—But Keep the Umbrella Handy

There’s no shortage of potential problems—but none have fully materialised.

It’s a timely reminder that, amid all the angst, the biggest risk for investors is often being out of the market.

Trump Bluffs—Markets Bite

Despite the mantra “never trade on politics”, markets continue to act in haste.

Our focus on mitigating volatility remains valid—but just as important is staying alert to behavioural traps. In times like this, clear communication with...

Relief rally or false comfort?

The latest market rally can only be described as relief exuberance.

The word on the street is still “Trump crashed the markets”—but has he? Global equities have quietly risen in 17 of the last 19 sessions

TAM Talks - Weekly Update - 12th May 2025

Markets have been behaving like a swan in recent weeks—calm on the surface, but paddling furiously underneath.

Reports that US and Chinese officials were meeting in Switzerland for trade discussions helped lift market sentiment, as investors hope...

TAM Talks – Weekly Update – 6th May 2025

Encouraging news on trade—including a softening in auto tariffs and China waiving its 125% tariffs on some US products—markets were buoyed by strong earnings from Microsoft and Meta.

TAM Talks – Weekly Update – 29th April 2025

Yesterday, Spain experienced the worst power blackout in its recent history.

we want to reassure our clients that investments remain unaffected and operations at TAM continued as normal.