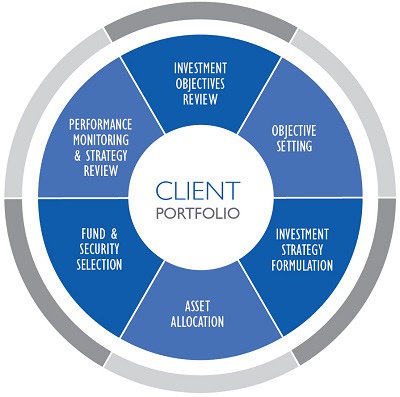

Investment Objective Setting and Review

It is key to ensure that, from the outset, every client has a realistic idea as to what they can expect from us. Therefore, before your client signs up to our service, you must ensure that you have established an accurate investment objective with them. This will form the cornerstone of how TAM manage their assets. We understand that as time goes on your clients’ personal circumstances or investment horizons may change, so we suggest that all clients’ investment objectives are continually reviewed. This will ensure that any changes are noted immediately, so that their portfolio can be re-evaluated to ensure it remains aligned to their current circumstances.